It's not a bug, it's a feature: Revisiting Kahneman and Tversky's insights on subjective satisfaction

The good reasons behind reference-dependence

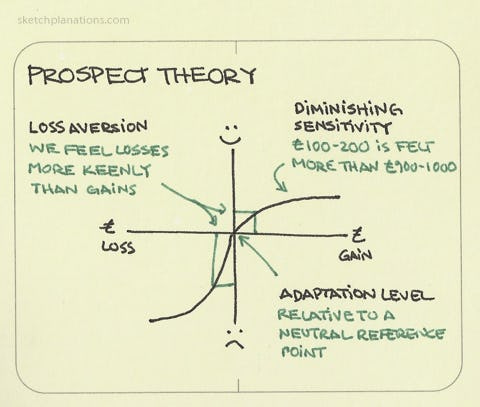

Kahneman and Tversky arguably proposed the most influential set of ideas in behavioural economics under the name of “Prospect Theory”. Their ideas are commonly seen as characterising flaws in human cognition. Here I show that there are good reasons to see some of the patterns from Prospect Theory as an optimal solution that emerged from evolution.

Thinking in terms of gains or losses relative to a reference point

One of the pivotal insights from Prospect Theory is that subjective satisfaction isn't based on our absolute outcomes (such as our total wealth). Instead, the link between our outcomes and our subjective satisfaction follows three principles:

We compare our outcomes to a reference point relative to which we perceive them as gains/successes or losses/failures.

We are more sensitive to gains and losses around the reference point (diminishing sensitivity).

We are more sensitive to losses than to gains (loss aversion).

In short, being rich won’t make you happy per se. What will make you happy is being richer than a reference point. This reference point could be your level of wealth yesterday (status quo), the level of wealth you expect you should get given your work/skills (expectations), or the level of wealth of some group you aspire to be like (aspirations). It is fair to say that these ideas have been influential in economics. Kahneman and Tversky’s 1979 article that put together these ideas has garnered more than 78,000 Google Scholar citations, making it the most cited paper in economics ever. At a time when many psychology results do not replicate, it is worth pointing out that empirical studies have provided strong support for the robustness of Prospect Theory’s principles.

In this post, I will look at the first two principles: the existence of a reference point and the diminishing sensitivity around it. These two principles are often gathered under the term reference-dependent preferences. Compared to other behavioural economic findings these principles are not primarily characterised as biases. But they tend nonetheless to be seen as cognitive flaws. On that point, Kahneman himself stated in his Nobel Prize acceptance lecture, that the alternative assumption—that subjective satisfaction is a function of absolute wealth —aligns with traditional economic theories on rationality. Therefore, the fact that subjective satisfaction is relative to a reference point could be regarded as one of the most significant deviations from economic rationality identified by behavioural economics. This view is sometimes stated by economists:

Reference-dependent preferences theoretically and reasonably explain individuals’ irrational behaviors when making decisions under uncertainty. - Liu, Li, Deng, 2022

To get an idea of what economists think, I put a poll on Twitter. The majority viewed the fact that our subjective satisfaction is relative to a reference point as a cognitive bias:

This post will take a different view and present an explanation that, surprisingly, most behavioural economists are unaware of. Namely, our subjective satisfaction is relative to a reference point because it is an optimal solution to the problem of perceiving subjective value.

Reference dependence as an optimal solution

Let's begin by asking a simple question: what is subjective satisfaction? A simple answer is that it's there to guide our decisions towards favourable prospects and away from unfavourable ones. Your subjective reward system can be thought of as a mechanism of informative signals, attributing positive values to outcomes beneficial to your survival and success (like eating well or being in good health) and negative values to outcomes that are detrimental (like being hungry or injured).

Let’s take an evolutionary perspective and assumes that evolution has done its work well and has led to an optimal subjective reward system. How would such a system look like?

The logic of evolution should lead signals of subjective satisfaction to be increasing with outcomes positively associated with fitness. To take an example, let’s consider a fruit with different degrees of ripeness, like a banana, and let’s assume for the sake of this example that a ripe banana is better to eat because (perhaps because it contains more fructose). Your subjective reward system ought to guide you in selecting the best banana, for instance, when faced with the choice between two at a market stall.

The left panel of the picture below shows how subjective satisfaction helps you make the right choice by giving different values to the different options.

Consider two constraints that your subjective reward system is likely to encounter while guiding your decisions. First, subjective satisfaction, being a signal produced in the brain, must inevitably have limits. There are only a finite number of neurons capable of producing this signal, and their firing rate is not unlimited. Thus, there is an upper limit to the level of subjective satisfaction one can perceive at any moment in time. Think of the best experience you could possibly have, like landing your dream job or witnessing your team win the world cup. Similarly, there is a lower limit to the satisfaction your brain can generate as a signal. This constraint is illustrated in the figure above, where subjective satisfaction is bounded above and below.

This constraint is not a problem in itself if the perception of value is sharp enough. In that case, even small differences in satisfaction can help you choose between two options. However, our subjective reward system faces a second constraint: it can't be perfectly precise. Our perception is always somewhat fuzzy.1 Much like the difficulty you'd face determining which of two pencils is heavier, identifying your preferred choice between two very similar options can be hard. This imprecision in your perception is represented on the right panel by the fact that your perception of value could end up anywhere inside a band around the value function. When the outcomes you're considering are close, you may not be sure which one you prefer.

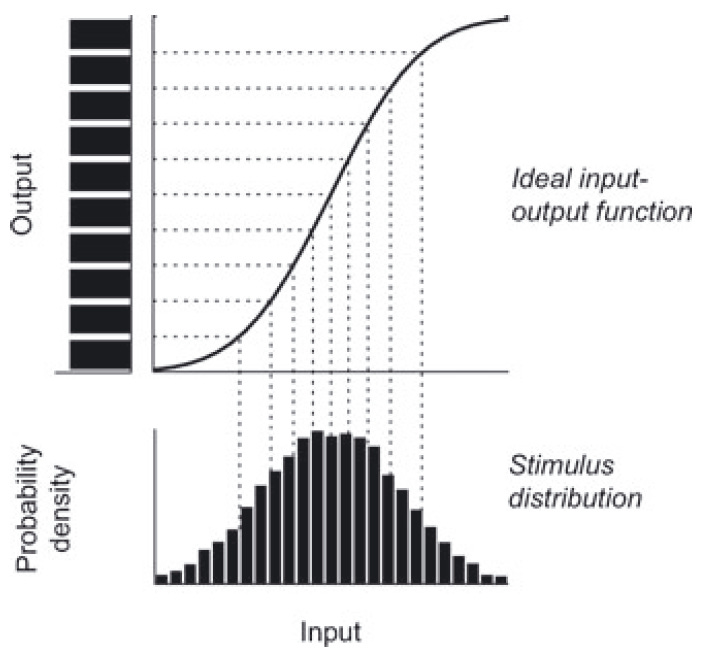

To compensate for this imprecision, there is a simple solution: increase the slope of subjective satisfaction. For a given level of imprecision, a steeper slope will lead to larger perceived differences in satisfaction between close options. This allows discrimination between outcomes that are close, as shown in the left panel of the figure below. But since your subjective satisfaction is bounded, the slope cannot be steep everywhere. The question is therefore: where should the slope of your subjective satisfaction be relatively steeper?

The optimal solution to this problem is that the slope of your subjective satisfaction should be steeper in the range of outcomes where you are most likely to face options that you need to consider in your choices (right panel). By being steeper in that range of outcomes, your subjective reward system will minimise the errors you are likely to make due to your imprecise perception.

The S-shaped curve of the Prospect Theory subjective value function thus naturally emerges as the optimal solution to the problem of value perception under two simple and credible constraints that evolution would have faced when designing our subjective reward system: your perception of value is bounded and not perfectly precise. This solution was established in complementary papers by Arthur Robson (2001), Luis Rayo and Gary Becker (2007), and Nick Netzer (2009).

The evidence from neuroscience

Evidence from neuroscience indicates that our perceptual system is reference-dependent. Our visual perceptual system, for instance, only encodes deviations from a baseline that tracks the average light intensity.

Changes of light intensity up or down from that baseline level are all that is encoded by the rods and cones of the retina as they communicate with the rest of the nervous system. Let me be clear about what I am saying here: Information about the objective intensity of incident light is irretrievably lost at the transducer. - Glimcher (2011)

But this is not seen as a bug, instead, it is seen as a feature of what has been called efficient coding, since the work of the neuroscientist Laughlin (1981). It is now well-accepted in neuroscience that the sensitivity of an optimal perceptual system should reflect the distribution of the stimulus it measures. This idea closely corresponds to the optimal solution for a subjective value function found in economics.

As highlighted by Paul Glimcher in his book, Foundations of Neuroeconomic Analysis, the fact that our perception encodes values coming from the outside world as deviations relative to a baseline “reflects an underlying process of optimization.”

What it means

The results on the optimal nature of reference-dependent subjective satisfaction have been published in highly regarded economic journals. They are now routinely discussed in neuroeconomics. Yet, surprisingly, they are virtually absent from the standard body of work taught in behavioural economics classes. In the impressive overview of the behavioural economic literature offered in the book The Foundations of Behavioral Economic Analysis (1799 pages!), this explanation doesn't get a mention. Similarly, you won't find this explanation in the 77 pages of the otherwise excellent Chapter 1 of the Handbook of Behavioural Economics on reference-dependent preferences. In short, the community of behavioural economists has yet to catch up with this explanation of the Prospect Theory subjective value function.

Some behavioural economists might ask, "So what? Do we need to know the reason behind Prospect Theory principles to work with them?" My answer is an emphatic yes. First, this explanation shifts the focus from reference-dependence being a cognitive flaw to an adaptive, optimal solution under the biological constraints our cognitive system faces when making decisions. It's important to the extent that it should encourage researchers not to just look for what's wrong with the way our subjective satisfaction works, but also what's right with it and how it aids in our decision-making process.

Second, it helps make sense of how reference-dependence works, and thereby provides answers to persistent puzzles in behavioural economics. One of these puzzles has been the question: “how is the reference point determined?” In their 1979 paper, Kahneman and Tversky proposed that it can often be the status quo, but it can also differ from it:

Kahneman and Tversky didn't offer definitive guidance on how it should be set. As a consequence, “the question of what is the reference point has been a major topic in the literature” (O’Donoghue and Sprenger, 2018). To get an idea of what economists think about this question, I conducted another Twitter poll. Should it be the status quo, expectations, or goals/aspirations? Answers were split.

The advantage of understanding how reference-dependence emerges as the optimal solution described above is that it resolves the question of the determination of the reference point in one fell swoop. The reference point, which we can associate with the midpoint on the S-shaped function will always be the expectation.2 However, the level of this expectation can vary. Frequently, expectation aligns with the status quo: most days, you expect your wealth to be the same as it was yesterday. In other situations, your expectations won't match the status quo. Especially when opportunities present themselves, your expectations might diverge greatly from the status quo. In that case, your reference point will take the form of a goal or aspiration level. The answer to the poll question is therefore that these different definitions of the level of a reference point are not incompatible once we see them as reflecting a level of expectation.

To summarise, the existence of a reference point that serves as a baseline for subjective satisfaction sharpens decision-making where it matters the most. Since our expectations often align with the status quo, it's natural for us to be especially sensitive to deviations from it, whether gains or losses. This heightened sensitivity near the status quo improves our perception of the value of the options we face, enabling us to make better decisions. However, when our expectations differ from the status quo, it's beneficial for heightened sensitivity to revolve around a reference point located in the range of outcomes we're likely to encounter.

Interestingly, this link between Prospect Theory’s subjective value function and the principles of perception was pointed out by Kahneman and Tversky themselves in their 1979 paper. Somehow, this connection was not extensively explored in the field of behavioural economics afterwards.

Finally, I understand that some readers might still have a question: "But what about loss aversion?" That... is a topic for another post.

This is the last of a series of three posts on “biases” that are not actually biases. The first two posts were on the hot hand fallacy and the confirmation bias. To make sure you receive notifications about the next posts, click “subscribe”. The content of this Substack is free.

References:

Dhami, S., 2016. The foundations of behavioral economic analysis. Oxford University Press.

Glimcher, P.W., 2011. Foundations of neuroeconomic analysis. Oxford University Press.

Kahneman, D. and Tversky, A., 1979. Prospect theory: An analysis of decision under risk. Econometrica, 47(2), pp.363-391.

Laughlin, S., 1981. A simple coding procedure enhances a neuron's information capacity. Zeitschrift für Naturforschung c, 36(9-10), pp.910-912.

Louie, K. and Glimcher, P.W., 2012. Efficient coding and the neural representation of value. Annals of the New York Academy of Sciences, 1251(1), pp.13-32.

Netzer, N., 2009. Evolution of time preferences and attitudes toward risk. American Economic Review, 99(3), pp.937-955.

O'Donoghue, T. and Sprenger, C., 2018. Reference-dependent preferences. In Handbook of Behavioral Economics: Applications and Foundations 1 (Vol. 1, pp. 1-77). North-Holland.

Rayo, L. and Becker, G.S., 2007. Evolutionary efficiency and happiness. Journal of Political Economy, 115(2), pp.302-337.

Robson, A.J., 2001. The biological basis of economic behavior. Journal of economic literature, 39(1), pp.11-33.

Sayood, K., 2005. Introduction to data compression. Morgan Kaufmann.

It is built into our neuronal processes that encode stimuli with a part of randomness.

Assuming for simplicity that the distribution is unimodal and symmetric, like a normal distribution.