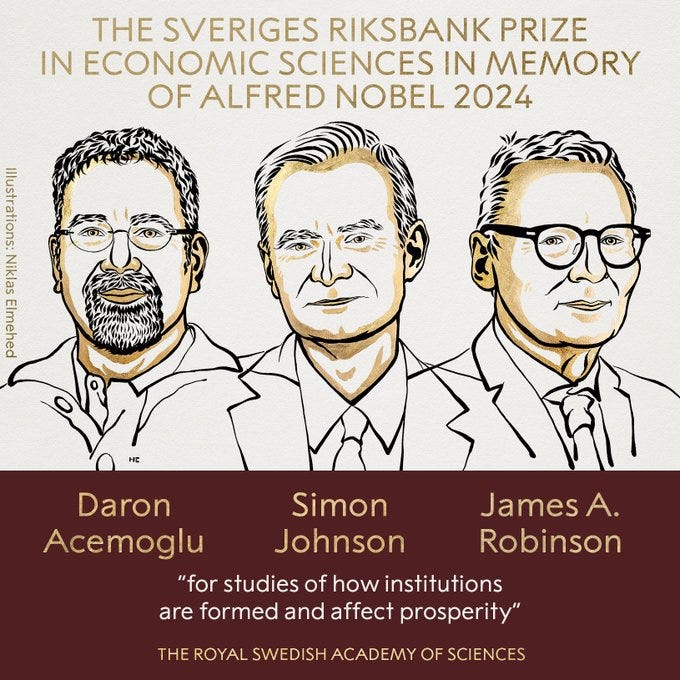

Expanding economic boundaries: The contributions of Acemoglu, Johnson, and Robinson

The new economics of power and institutions

Economics has developed a coherent conceptual framework to think about markets and analyse them through formal mathematical models. However, the discipline has often been criticised for presenting a narrow view of the world, relying on models that fail to capture the rich complexity of human institutions.

Anthropologist Karl Polanyi is frequently cited as a counterpoint. In his influential book The Great Transformation, he argued that markets do not exist in a vacuum. All economic activities are deeply embedded in social relations, institutions, and cultural norms.

The strongest criticism typically comes from left-wing thinkers, who accuse economics of overlooking a crucial aspect of social relations: power. The unequal distribution of economic resources enables members of elite groups to influence institutions to their advantage. By ignoring this fact, economics has been accused of serving as an ideological justification for free-market capitalism and the inequalities it generates.

These critiques are not entirely irrelevant to how economics has historically operated. However, expressed in these terms today, they overlook the “institutional revolution” that transformed the discipline. Ignited over twenty years ago by Acemoglu, Johnson, and Robinson (AJR), this revolution placed the study of institutions at the core of economic research, providing fresh insights into two key questions: Where do institutions come from? And what is their impact on economic activity?

Old-style economics: beautiful but unreal

There is validity in the critique that, for a long time, economists relied on models with limited realism to advocate for market economies. The “general equilibrium theory,” completed by Arrow and Debreu’s work, stated that an economy composed of idealised markets could reach equilibrium—a set of prices where supply equals demand in every market. The associated welfare properties of this equilibrium, such as no gains being left on the table, were often used to justify market mechanisms.

This approach was leaving two gaping holes: How does the economy converge to this equilibrium? And does the theory reflect real-world markets? Nobel laureate Vernon Smith, who studied markets in laboratory settings, noted that actual markets reach equilibrium under conditions quite different from those assumed by the theory. Moreover, the vast differences between real markets and the assumptions of general equilibrium theory make its use as a justification for real-world markets rather precarious. After the achievements of general equilibrium theory, economics has evolved in large part through recognising market imperfections, particularly informational imperfections, which cause deviations from the general equilibrium ideal.

In this perspective, the institutional revolution has added a significant layer to the discipline’s understanding of economic interactions. Following early works on institutions by economists such as Douglas North (1990) and Elinor Ostrom (1990),1 AJR contributed to a deeper understanding of the origins and effects of institutions, both theoretically and empirically.

Where do institutions come from?

From an economic standpoint, institutions can be seen as entrenched social conventions, strengthened by codified texts like laws or constitutions (Basu, 2018).2 As rules governing social interactions, they may emerge naturally from practice (Hayek, 1973). However, what works in practice often reflects what is sustainable, given the bargaining power of different social groups (Binmore, 2005).

Societies are not characterised by a perfect equality. Inequalities in material resources and access to means of violence lead to differences in bargaining power: some people have a greater possibility to impose economic coercion or the threat of physical harm on others. These differences in bargaining power shape the institutions that emerge in a society. AJR brought these questions to the forefront of economic inquiry, using game theory and econometric tools to study them.

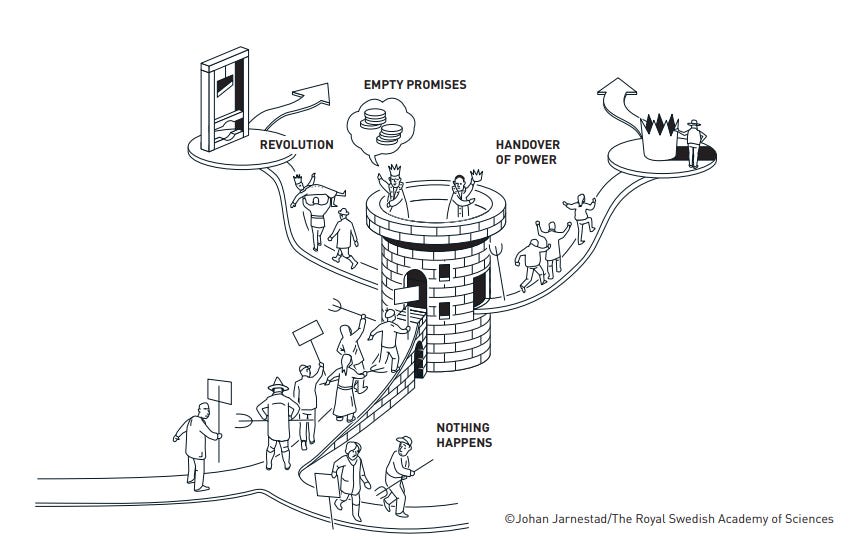

AJR explicitly considered self-interested elites who shape institutions to their advantage while trying to avoid political revolutions that could threaten their rule. For example, they argue that, in the West, elites extended the franchise strategically to reduce the likelihood of revolution while maintaining a diminished, yet significant, hold on power.

Why did the ruling elites in these societies agree to redistribute their resources and to give up control of formal political institutions? Acemoglu and Robinson argued that this type of economic and political reforms can be viewed as strategic decisions by the elite to prevent social unrest and revolution that ultimately would damage them even more. - Nobel Prize Committee document

The key problem faced by the ruling elites is that when lower social groups are complaining, promises of redistribution lack credibility. The king may say, “I understand your plight, and I will improve your conditions. You can return home now.” However, once they disperse, nothing might happen. Then the unrest leaders might vanish, never to be seen again. In short, rulers face a commitment problem: they cannot credibly guarantee that they will honour their promises of redistribution.

Extending the franchise by giving political power to larger social groups, is a credible way for elites to commit to future redistribution while maintaining their grip on power. An alternative strategy would be to maintain their hold on power intact, risking political revolutions like the English Civil War (1642–1651) or the French Revolution (1789), both of which resulted in the execution of the king.

AJR initiated an important intellectual shift by introducing into economics key ideas about power struggles between social groups that were traditionally outside the discipline.3

What is the impact of institutions?

Another key contribution from AJR has been their analysis of the impact of institutions on development. Institutions can be inclusive, allowing individuals to flourish and reap the rewards of their efforts, or extractive, benefiting elites who live off the labour of lower social groups. The difference between these types of institutions is crucial because inclusive institutions provide incentives for people to work, while extractive institutions offer fewer incentives, as individuals cannot be sure they will benefit from their efforts. In countries with extractive institutions, elites can capture successful ventures (e.g. “It is a nice little firm you have here. Unfortunately, it has been found that it violates regulation X and will now be confiscated and placed under the control of the regional governor’s son.”)

AJR also point to a second reason: elites may resist innovation because it could lead to social changes that threaten their grip on power. As noted by the Nobel Prize Committee:

Entrenched political elites are inclined to obstruct beneficial economic and institutional change when they fear that such changes might destabilize the existing order, potentially jeopardizing their grip on political power and future privileges. - Nobel Prize Committee document

Two classic examples discussed in Acemoglu and Robinson’s book Why Nations Fail illustrate this. The first is China’s decision in the 15th century to close itself off to naval exploration. Before this decision, China had the largest navy in the world. Between 1405 and 1433, under explorer Zheng He, seven large expeditions reached as far as Africa. However, after the seventh expedition, the Chinese government turned inward, banning the construction of large seafaring vessels and prohibiting foreign arrivals.

The second example is the fate of the stocking frame, a machine invented by William Lee in 1589 for knitting stockings. When Lee presented his invention to Queen Elizabeth I, seeking a patent or royal endorsement, she rejected it, fearing it would lead to job losses among hand-knitters and unrest among her subjects. Lee relocated to France, where his invention was patented under the patronage of Henry IV.4

The argument that inclusive institutions foster growth has been supported by AJR’s empirical research on the differences in development across former European colonies. Two of their most cited papers (2001, 2002) show that territories either amenable to European settlement or sparsely populated and needing European migrants as a workforce are associated today with better institutions and higher levels of development. They argued that it is explained by the importation of their inclusive institutions by Europeans. This explanation has nonetheless been debated as Europeans not only brought their institutions but also their level of education with them (often considered a key ingredient of economic development).5

In AJR’s perspective, the problem of developing countries is not a lack of resources, a lack of education, or even a colonial past, but rather a lack of good institutions that protect freedom and property rights, creating incentives for wealth creation and innovation. Extractive institutions reduce incentives for innovation and shift incentives to invest instead in political connections to climb the ladder of the national elite and extract resources from others.

With their role in integrating institutions into economic analysis, Acemoglu, Johnson and Robinson have contributed to making economics a truly general social science, allowing discussions and studies from political science, sociology, and history to be integrated into economic research. Economists now study the evolution of institutions, the role of elites, and power struggles using game-theoretic models and historical data. AJR's work has opened economics to complex arguments about market effectiveness that also consider the influence of cultural and political institutions.

Today, economists tend to be favourable to markets not primarily because of the existence of an equilibrium in highly idealised mathematical models but because they are seen as inclusive institutions that benefit individuals and society as a whole. They provide incentives for people to produce what society needs, and people are rewarded for their efforts and innovations. At the same time, economists are not naïve about markets being abstract mechanisms existing outside their social context. The institutionalist perspective is a return to Adam Smith’s rich understanding of the economy. To study how market mechanisms work in practice, one must also consider the role of political institutions and recognise the incentives of elite groups to shape the rules of the economic game in their favour.6

References

Acemoglu, D. and Robinson, J.A., 2000. "Why Did the West Extend the Franchise? Democracy, Inequality, and Growth in Historical Perspective." Quarterly Journal of Economics, 115(4), pp.1167–1199.

Acemoglu, D. and Robinson, J.A., 2013. Why Nations Fail: The Origins of Power, Prosperity, and Poverty. Crown Currency.

Acemoglu, D., Johnson, S. and Robinson, J.A., 2001. "The Colonial Origins of Comparative Development: An Empirical Investigation." American Economic Review, 91(5), pp.1369–1401.

Acemoglu, D., Johnson, S. and Robinson, J.A., 2002. "Reversal of Fortune: Geography and Institutions in the Making of the Modern World Income Distribution." Quarterly Journal of Economics, 117(4), pp.1231–1294.

Basu, K., 2018. The Republic of Beliefs: A New Approach to Law and Economics. Princeton University Press.

Binmore, K., 2005. Natural Justice. Oxford University Press.

Fukuyama, F., 2011. The Origins of Political Order: From Prehuman Times to the French Revolution. Farrar, Straus and Giroux.

Hayek, F.A., 1973. Law, Legislation and Liberty: A New Statement of the Liberal Principles of Justice and Political Economy. London: Routledge & Kegan Paul.

North, D., 1990. Institutions, Institutional Change and Economic Performance. Cambridge University Press.

Ostrom, E., 1990. Governing the Commons: The Evolution of Institutions for Collective Action. Cambridge University Press.

Polanyi, K., 1944. The Great Transformation: The Political and Economic Origins of Our Time. New York: Farrar & Rinehart.

Robinson, J., 1962. Economic Philosophy. 1st ed. New York: Routledge.

Smith, V.L., 2007. Rationality in Economics: Constructivist and Ecological Forms. Cambridge University Press.

Smith, A., 1776. An Inquiry into the Nature and Causes of the Wealth of Nations. London: W. Strahan and T. Cadell.

They were awarded the Nobel Prize in 1993 and 2009, respectively.

Douglas North defined institutions as “rules of the game in a society […] which structure incentives in human exchange, whether political, social, or economic” (North, 1990). Elinor Ostrom shared this perspective.

How do institutions evolve in practice? Do they emerge in a bottom-up process or a top-down process?

Hayek famously argued that institutions are social rules that evolve gradually and accumulate because they work and successfully coordinate social activities. The idea from the French Revolution that institutions can be rebuilt from scratch is naïve and ultimately dangerous, as it underestimates the usefulness of existing institutions and the unforeseen challenges new institutions may face.

Hayek’s point is deep and, I believe not appreciated enough. However, he likely went too far with this bottom-up explanation of institutions and underestimated the potential for top-down institutional innovation. Fukuyama, in his review of Hayek’s views, pointed out that he overlooked significant institutional innovations that were not bottom-up in nature, such as religious doctrines or the imposition of Common Law by European kings.

Hayek’s normative preference for a minimal state seems, however, to have colored his empirical views about the origins of law. For although law did precede legislation in many societies, political authorities frequently stepped in to alter it, even in early societies. And the emergence of the modern rule of law was critically dependent on enforcement by a strong centralized state. - Fukuyama (2011)

History shows that specific events can create “critical junctures,” setting a country on one institutional path rather than another. This idea is central to Acemoglu and Robinson’s book, Why Nations Fail. The English Glorious Revolution, leading to the Bill of Rights (1689), may have been critical in establishing an institutional framework that protected property rights and fostered innovation, paving the way for the Industrial Revolution.

Hence AJR’s view on institutions leaves the possibility that specific events, potentially from unexpected outcomes of a political conflict, may lead to institutional innovations one way or another and influence a country’s future development.

These two examples illustrate one of Europe’s paradoxical advantages over China at the time: its political fragmentation allowed innovation to flourish through competition among different elites and their national institutions. Fukuyama develops this idea further in The Origins of Political Order.

For critiques of the empirical evidence in AJR’s work on the effect of institutions on growth, see this post by Noah Smith, this post from Marginal Revolution and this Twitter thread by Cremieux. While I have a more positive view than Noah Smith on the significance of this prize, I nonetheless share his broader concern that such awards can distort perceptions of intellectual contributions, placing certain researchers on a pedestal and making it harder to critique their work.

It is often overlooked that Adam Smith, while a proponent of market mechanisms, was also critical of oligarchic capture:

The proposal of any new law or regulation of commerce which comes from [businessmen] ought always to be listened to with great precaution. [They] have generally an interest to deceive and even to oppress the public. - Smith, The Wealth Of Nations, Book III, Chapter XI

Great post Lionel! Good context and explanation (and clearly better than some others I've seen!).

Amazing article! It’s been clear to me that institutions are the most important variable to a nation’s success since studying development economics. I found it strange that this was considered controversial. I’m happy to see the work of AJR winning the Nobel prize!